Run For The Roses

Russia, Realpolitik, and Non-Renewables

“There are decades where nothing happens; and there are weeks where decades happen.”

―Vladimir Ilyich Lenin

If subscribed to the various headlines emanating from the global press, you may feel like the world is on fire at the moment. Be grateful for the glut of media content at your fingertips, and trust that we’ll continue to sift through it.

Let’s take stock of recent events.

The Nordstream II pipeline sprung a leak in recent weeks, prompting Brussels to pitch a fit. Moscow has pointed fingers, wasting no time in alleging “state-sponsored terrorism,” and mincing no words in outlining a response if rumor were to become a reality. You may remember that the image-obsessed Russia began to demand Rubles as payment for natural gas delivery to Western Europe in May, though Putin eventually allowed (quietly) a EUR/USD loophole after headlines died down. The plan seemingly worked as intended; Western Europe’s dependency on Russian gas was seared in the minds of the world.

As of late, Russian brass has claimed possession of evidence that Ukrainian actors plan to detonate a dirty bomb in an effort to stoke the conflict further; the motive assumedly being to force more unequivocal involvement of greater powers (cough cough USA)—who have, up until this point, maintained a quasi-Lend-Lease Act arrangement with Ukraine.

Let’s talk motive.

While Russia is purportedly holding their own militarily on some fronts, after this is all said and done, Russia’s already-declining birth rate stands to look even worse once true casualty figures culminate (if at all). Tens of thousands of Russian Troops are reportedly KIA, with scores more captured and wounded. With reports of elderly and disabled Russians being conscripted, along with the emptying of prisons to fill ranks arriving almost weekly on social media, we can’t imagine many able-bodied men are left to tend to prized energy infrastructure that Russia has dangled over the likes of Germany as we inch closer to Winter.

Profile on Putin

Putin is driven by the ethos of a sociopathic Boy Scout; this assessment is exemplified by decisions such as his refusal to let go of the Donbas, his waste of “elite” Wagner Mercenaries on heavily fortified cities such as Kherson and Kharkiv, and his insistence that he is “Denazifying” Ukraine. He’s lost the plot — the shtick got too good, his circle is chock full of yes-men, and he’s sipping his own Kool-Aid. Either Putin believes he is a king backed by a mandate of heaven to reclaim the Kievan Rus with Mercenary armies, insistent on ceremony as a dogma, or he’s insecure about his own personal safety and power to the extent that he’d lead >30,000 countrymen to slaughter in America’s crash test lab for conventional military tech.

Both scenarios bode dangerously for the West. A dogmatic and passionate Putin means a full-court press on the Donbas; with Russians refusing to quit until literally outgunned. An insecure Putin will continue with the former; he will welcome the heightened theater as the resulting chaos plays to his advantage; he is the strongest strong man on the block, and war wins elections, though not as much as stuffed ballot boxes.

Both scenarios also invite the risk of heightened conflict (chemical or worse). Putin is playing by a rulebook foreign to NATO and the rest of the west.

For example, the Donetsk People’s Republic attempted to use British Aid Worker Paul Urey as a bargaining to chip to force Great Britain’s formal recognition of the breakaway state; though GB does not negotiate with terrorists, official recognition of sovereignty would have ideally opened up a path to secure Urey’s freedom. Urey died this week in the hands of the DPR.

The annexation campaign of the Donbas warps the Liberal system, with Putin capturing territory in the east, hastily holding elections, then declaring Russian commitment to preserving the sovereignty of the new breakaway states (along with protection of Russian-speaking peoples). By bending the rules and attempting to pass these actions off as dignified or normal, he is seriously damaging Westphalian sovereignty as we know it. Putin’s smearing of lipstick on a pig only drives one to wonder what country will try something similar next.

Will Putin fire Nukes?

Unlikely at this point, it would escalate the conflict to an extent we haven’t seen in decades. Though Western media may paint of picture of brimstone and hellfire, we are far from going nuclear. To do so would be the end of Russia.

So how does this end? Russian sentiment is already wavering in the wake of Putin’s partial mobilization. With Neocons calling for statebuilding in Russia , reports of sporadic shootings by disgruntled conscriptes, and tell-all videos recorded by Russian troops themselves detailing the shit kits provided to them, it is clear that Russia is, to some extent, a paper tiger failing to “walk the walk” that Putin has talked for over a decade.

As Europe is currently overflowing with Natural Gas, the whines of Western Europe are expected to die down as winter approaches. We doubt this development will prove to nudge Putin much, as he seems to be post-money at this point. After all, Russia is already expelled from SWIFT.

What else should I be following regarding Russia?

Keep an eye on Africa. Silently, in the past decade, vulnerable African countries - often dealing with multiple successive coups in a short period of time - have enlisted the aid of Wagner Group, a mercenary outfit owned by Yevgeny Prigozhin (Putin goon and restauranter). In addition to dispersing troops to Syria and the Donbas in the early 2010s, Prigozhin has silently courted many Central and Sub-Saharan African countries, offering cheap “security assistance, policing, and training” in exchange for favorable mining, vanilla, and other commodity extraction contracts.

Russia obtains ease on C.Africa arms embargo at UN Security Council

Further, while China has opted mainly for economic diplomacy in Africa, Russia has been busy negotiating permission to build military bases on the continent, particularly in the Central African Republic, Egypt, Eritrea, Madagascar, Mozambique, and Sudan.

The US government warned Sudan of the consequences of allowing such construction earlier this month, and Prigozhin’s congratulation of Capt Ibrahim Traoré amidst his recent coup deposing previous junta leader Lt Col Paul-Henri Damiba leaves us with all eyes on Africa.

How do I trade this situation?

Luckily, the new African front only contributes to the broader global conflict part and parcel. We are watching the Black Sea. We are watching the Med. We are watching the Suez. We are watching Turkey, as Erdogan entertains Israel and the Gulf states in hopes of housing a new Nat-Gas pipeline for transmission from the Eastern Med. to Western Europe.

Our winter picks:

Energy:

Uranium is ESG ($URA)

With winter approaching, Western Europe narrowly avoided a deep freeze, now sitting with more LNG than they can store. In the summer, though, powering up dormant plants was all the rage. While Germany decided not to pursue nuclear power long ago, France has fast-tracked construction of 6 new plants slated for the next 5 years. Just days ago, Canada’s Federal Infrastructure Bank lent nearly C$1 billion to an Ontario utility for the construction of a small modular reactor, a first among the G7. With 2050 net-zero goals looming on hand and Russian flagrance having the potential to seal the rest of the West off from 50% of global enriched Uranium supplies, URA 0.00%↑ is a no-brainer.

With all this talk of nuclear war, nuclear power can’t be too far downstream…

Oil ($USOIL)

We are bullish for 2 key reasons:

1. Europe is expected to formally ban oil imports from Russia as early as next month (Russia provides ~10% of global supply)

OPEC production cuts of 2 Million B/D slated for November

Keep on eye on Africa regarding #2. Congo has recently joined OPEC, and Namibia may join next. While we refrain from speculating on this potential new joiner’s effects on production, the Sahel, Horn, and Sub-Sahara remain wildly volatile and increasingly Russia-aligned, making this market much more interesting. All in all, the continent’s recent growth has and will continue to rely on cheap fuel. You may have recently seen French Company Lafarge pled guilty in US courts to the charge of providing material support to terrorist groups. Recent coups one after another in countries such as Burkina Faso & Mali-driven by local disapproval of efforts to combat Islamic jihadism in the Sahel-have invited resulted in open invitations to Wagner Group forces; in other words, we would not be surprised if a Lafarge-esque situation(s) became the norm in resource-rich parts of Africa.

“While they’re(Russia) playing chicken with Europe, 74% of their total end demand for Natural Gas is Europe - their transmission mechanism for gas is pipelines, and they’re nailed to the ground.”- Marko Papic

Agro Futures:

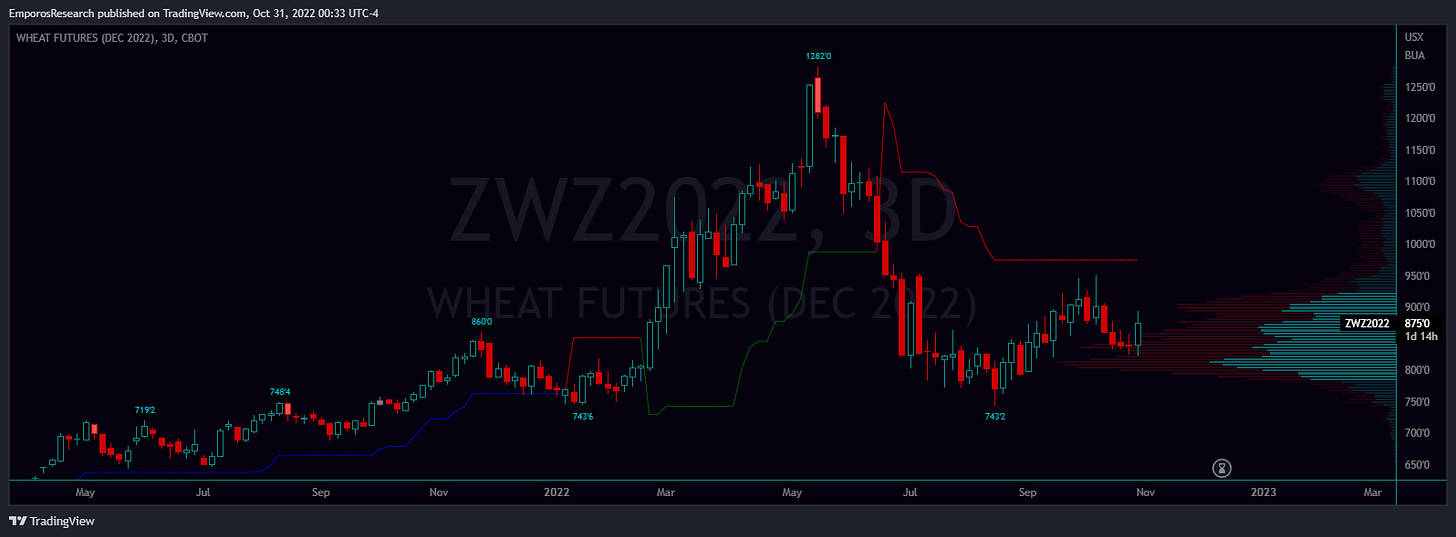

Wheat (ZWZ2022) (Up 6% on the month)

With droughts hitting as close to home as New Jersey, the 2020s have been ripe with foodstuffs volatility. As there is a drought in Southern Europe, food prices have been labeled the second largest factor driving inflation in the EU. With Ukrainian ships unable to depart ports in the Black Sea due to the conflict, we continue to watch wheat for new highs, notably as Russia announced intentions to exit the long-awaited deal to allow Ukrainian grain exports from the Black sea, citing drone attacks on the Russian naval fleet in Sevastopol. Further, low Mississippi river Delta levels have complicated domestic agro barge transport, choking the usual supplies flowing from soybean and wheat farmers to customers globally.

Corn (ZCZ2022) (Up 3% on the month)

Soybeans (ZSF2023) (Up 2% on the month)

Soybean price per bushel holds steady at 8 year highs

Rough Rice (ZRF2023)

At home; a looming Railroad strike threatens to depress agro transport nationwide.

In short:

A decade of cheap money has left us with only fleeting memories of meme stocks and Tech bubbles. As a bloody conventional war rages on in Europe, we feel this global growing phase will drive volume “back to the basics” as we are reminded of what’s needed for everyday survival.

[Verse 2]

Run for the money, caught short on the rent

Big ideas but the cash's all spent

The trouble with love is its other face

You just want the cup, but you don't want the race

No, you don't want the race

[Chorus]

Run, run, run for the roses

The quicker it opens, the sooner it closes

Man, oh, man, oh, a friend of mine

all good things in all good time