Market Insights Part 2

New trends and cycles are shifting markets...

March 3rd, 2022

Markets Insights Part 2

Hello investors, Traders, and market participants.

The era of Geopolitical risk has begun. Welcome to Emporos Market Insights part 2. These are tragic times, and we do not control how these governments operate. With that said, in the second edition of market insights, we will analyze the crypto markets, commodities, and a few companies worth watching in the stonk market.

There's no need for an introduction to what's happening. The lull in the markets since November has ended. Recently they have been volatile, trending hard, and more profitable than ever.

Bitcoin Market 3/4/22

Fisher algorithm signals no significant change in trend just yet. Since our last issue, our forecast was spot on, and Bitcoin fell from $45k to as low as $34k. You can read Part One of the Market Insights Report here.

Price Action Catalysts

The media, Federal Reserve, and powers in the government are targeting the crypto industry again. You see firsthand the seizures of bank accounts, crypto exchanges, and the ability for citizens to be excluded from the world system. Many of you probably do not need me to tell you this—just a reminder of how essential understanding and experimenting with other blockchain platforms truly is. As a company, we believe LUNA still has untapped growth. We are also speculating with third-party Dapps on Solana. Many VC, funds, and other backers support the Solana platform, so our thinking is finding a profitable coin like MNGO could pay off handsomely. The same thought process applies to side projects on the LUNA ecosystem.

Governments, however, are aware and taking notice. My sources report that the regulatory attacks will continue in even greater force over the coming months. You must try to minimize your exposure to centralized exchanges and support the development of decentralized technologies.

Geopolitical Risk

First, it was pandemic profiteering, and two years later, the world transitioned to weapon and war profiteering—rare events in our timeline. Our research indicated some global conflict would emerge once we saw the first wave of commodities spike in 2021. One of the reasons surrounding the current situation is a battle over resources. With everything in the country of Ukraine closed and no one to manage the land, agriculture has been skyrocketing. Wheat just hit limit-up. Corn which is Ukraine's most significant exporter, is rising rapidly, not too far behind Wheat. Ukraine also has the largest deposits of Titanium in Europe. Yes, you heard me, combined with copper deposits and many more precious metals.

We as a company anticipate the conflict will not end anytime soon and are preparing for similar proxy wars to develop as resources become even more scarce.

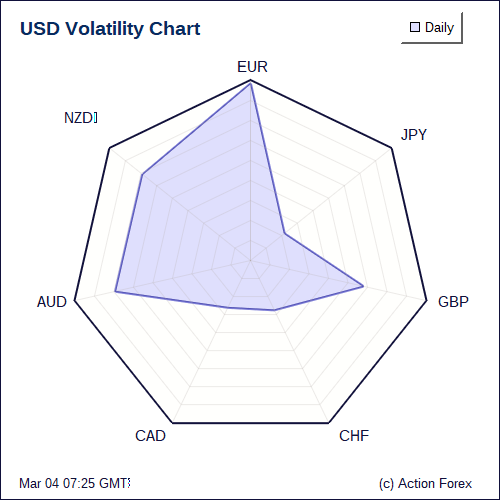

We will have more insights related to supply/demand regarding upcoming geopolitical risk if it becomes necessary. I anticipate a currency war as the forex market shows us record high volatility. Our analyst, Atlas, has been hard at work showcasing purely technical strategies to take advantage of the current market conditions. Join us in our live chat. Sometimes the best thing you can do is bounce ideas off other traders.

Defi Market

I mentioned a couple of platforms that can emerge and grow due to geopolitical risk. The truth is since November, we have trended downward with a total market cap of all cryptos at around 1.7 trillion. While there have been apparent weaknesses, a few platforms are standing out. The LUNA platform is still posting strength. While I am not recommending a buy-and-hold approach, as stated earlier, it will be profitable for newcomers and veterans to try the chain and understand how things are growing and developing. We are currently monitoring privacy coins, and if we see any new trends start to spark, we will inform you. Blockchain games will be another niche worth keeping an eye on as Virtual and Augmented reality become more prominent technologies. Keep an eye out and trust your judgment. No one knows how the space will develop. I hope my ideas help you in your search for the next trend.

What Is an NFT?

I have not mentioned NFTs because I see them as a way for people to flex, and over time they will be a way to imprint ownership on the Blockchain. For example, legal contracts or showing the digital world you are the owner of a physical item or rarity. Owning digital goods will be commonplace in the future; however, the only thing available to the public now is getting rich speculating on quick NFT schemes.

The current greed and having all these inferior products will not end well for 98% of them unless they adapt to future innovations.

The market is transitioning into a new cycle. Defense can be complex, as it jolts our inclination to invest in the market thoroughly. This statement becomes even more true in a period of high inflation. Volatile markets also exaggerate our fear and greed emotions that drive irrational behavior.

We will share a few ideas and market strategies to help the transition from offense to defense. The philosophy we, as a company, believe in is the strength of market ideas.

Be aware of aggressive upthrusts that tend to come viciously and without warning. We have seen examples of these moves in the indices as of late. Expect many more games to be played during the cycle. The demand for returns is about to go way up.