Ethereum's Crossroads

Solana Outshines Ethereum

What's Wrong With Eth?

Hello, everyone; this will be a quick article for the archives. So everyone can understand our current position, thoughts, and consensus on ethereum.

This is the updated statistics as of 3/18/2024

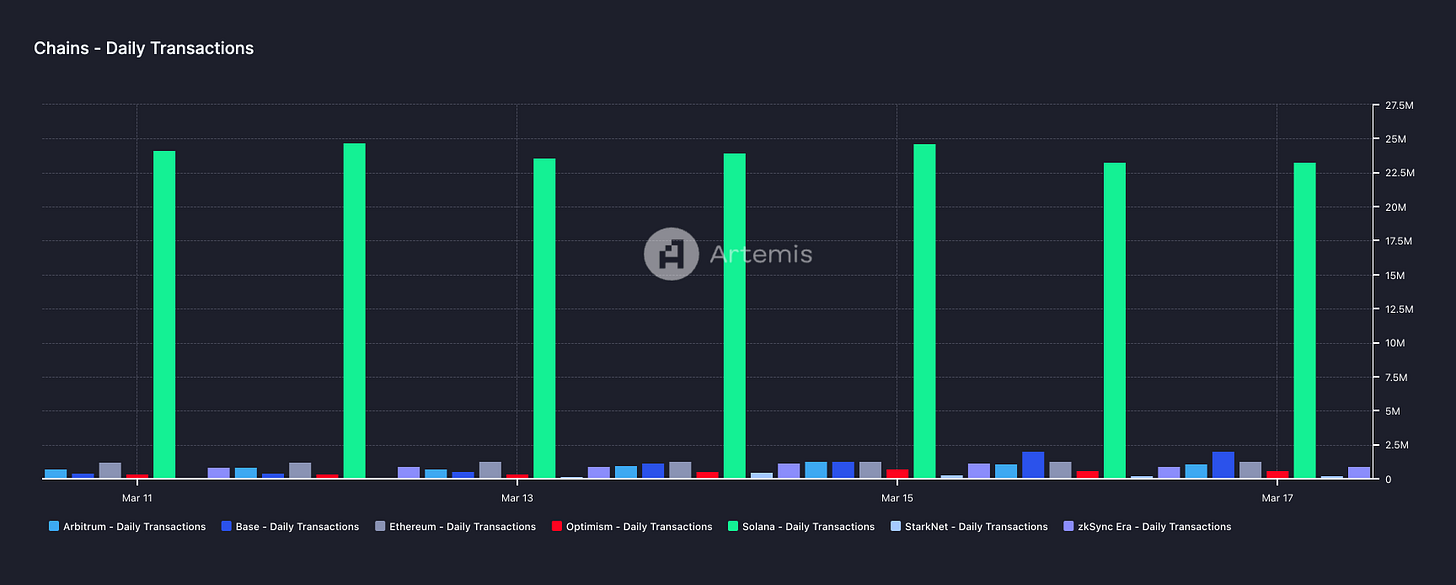

Solana Outpaces Ethereum Network Activity

As of 3/16/2024, according to DefiLama, surging past Ethereum's total trading volume by more than 1.1 billion.

Eth Killer Theory

For those of you who have followed me for a long time, you are aware of my stance on ethereum. In previous years, reflecting the first chart, you should hold Bitcoin at an average price of $20,000 until 2024. And absolutely do not hold any eth.

We also said that in 2023, as things were priming up, we should own all the platforms. You make money from a platform. All the L1 ETH competitors, Solana, APT, SUI, and more outperformed ethereum.

Dencun Upgrade Nothing Burger

"The overall effect should be lower costs, but users on the main blockchain (L1) won't enjoy these lower fees until at least 2026-27, says Pitchbook's crypto analyst Robert Le, until there is "full danksharding," referring to a rollup scaling method which provides extra storage for increased transactional capacity."

What's Next? Possible Scenarios

So what's next? Most market participants did not anticipate what is happening with Solana or expect Eth's underperformance to be this drastic. This gives us a significant edge. We will see eth/btc falter to the levels in our pivotal grid above.

We will likely see continued outflow from ethereum.

An ETF could drive demand for ethereum but solve none of its underlying problems. The L2s are super competitive, and with delays and failures being the norm for ETH 2.0, they may capitulate to other chains before the fix. This means no new money will be using the chain or platforms. There is even a possibility old money and institutions will exit spot and invest in the ETF.

Right now, trading ethereum is the best bet. Based on the reasons above, it is not worth locking up capital to stake or use the chain. Sadly, whatever remains on ethereum will most likely be inherited by centralized forces who continue to want to control the network. Big Banks, etc. What this means for price is ultimately what we are seeing happen.

Solana network is outperforming in terms of usage, and l2s are killing each other in a dog-eat-dog competition, with platforms migrating to new chains. The best trades and ideas are the ones that show movement from the outset. Does this recent news with Solana continue to validate our theory? Or will an ETH ETF be around the corner and help save ETH from its depressing performance? We will take advantage of all this. I hope you enjoyed this article.

-Emporos