Emporos Research Market Insights

Issue #1

Emporos Research Market Insights

February 1st, 2022

Welcome. We will be covering the state of the markets in a simple format. Remember, the critical formula of our trading philosophy comes from the core quality of ideas. The stronger the idea, the more money you make. Our job is to find ways to extract money from the market.

With that said, the markets seem to be in a trance, with a lot of the upcoming momentum coming from the Federal Reserve's next moves and a looming midterm election. Some weeks there are dozens of high-profit signals, and other times there are very few, if any.

The correlation between cryptocurrency and the traditional indices still exists, and most markets are currently experiencing a relief rally after a significant decline in January.

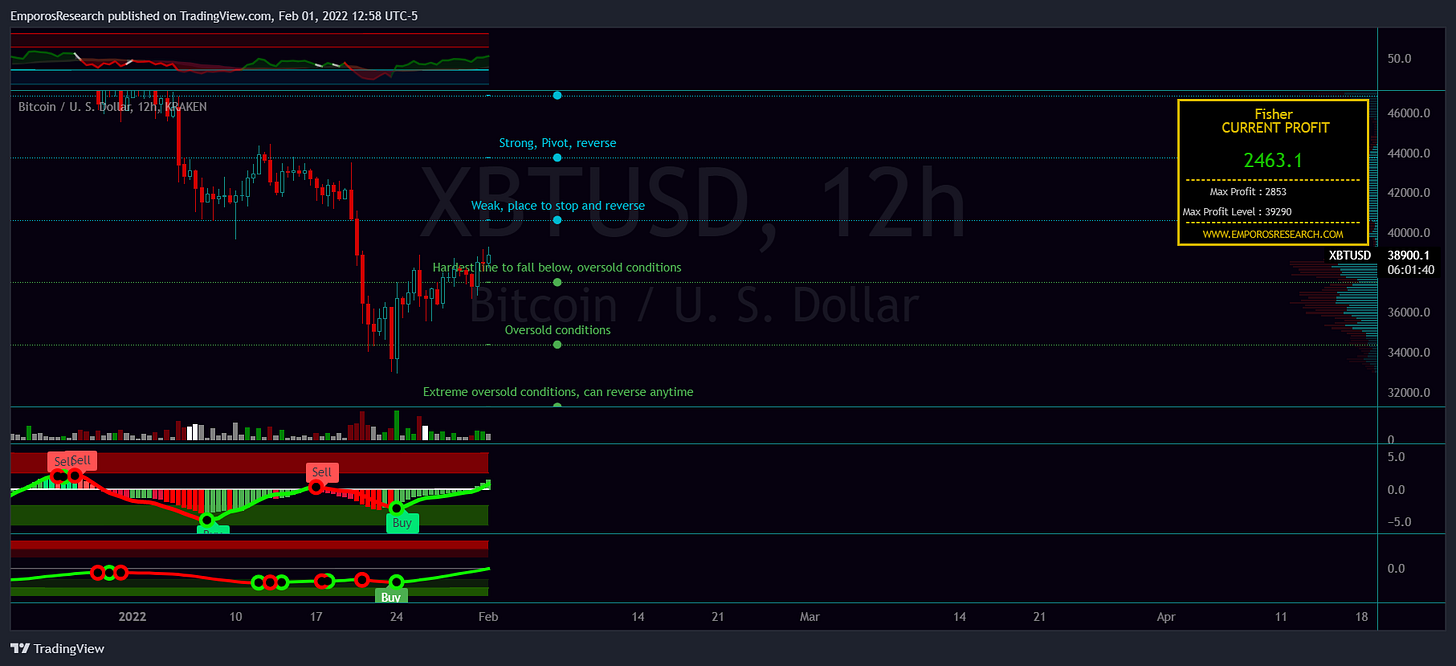

Our indicator tools signaled a buy at around 36k, and as I am writing this bitcoin topped 39k. As you can see, just buying spot bitcoin is a relatively low-risk way to gain 10% just from the nature of how bitcoin operates. Many altcoins started a "small" 60% rally after a 90% drawdown. Welcome to crypto; this is the nature of the beast and par for the course here.

While I believe in the industry as a whole and think by 2024, we will top over 10 trillion in total market cap. The infrastructure of the space is not strong enough yet. It is close, but just not quite there. We will be going through a slower cycle as more time is needed for the technology to keep growing and improving on top of continued regulatory changes.

Forecast: The scenario for a continued relief rally would see bitcoin run a little over 40k, with squeeze potential for 45k. Anything higher will result in a reevaluation of the market structure.

After calling and expecting the downside we have seen the past few months, I think it is only natural to "hope" for a prolonged relief rally instead of fear more downside. When trading, you should fear when people have too much hope and hope when there is too much fear in the air. This statement goes against human nature and makes for a robust market hypothesis because it goes against the core being of our emotions. February is historically a month where we do see much relief in assets.

Indices and Stonks

Six months later, every idea written here in the tweet thread came true. Except for TSLA, more on that below.

$AMC fell to $15.

$GME entered a strong correction

$APPL trended hard and maintained the uptrend

$CLOV completely collapsed under the $3 target.

$SPCE fully retraced all of its yearly gains.

$AMD had a spike toward the upsides after its dip.

$WISH fell hard from $11 and is now under $3

$NVIDIA hardly moved in price, proving to be an investment that went nowhere

$TSLA was the only one in this list slightly incorrect. The asset was full of volatility and kept moving up. However, urging caution on an investment currently valued at close to $6000 from $180 the last few years is crazy to me. So, I do not think investing in the asset during the summer of 2021 was a wise play. Already being an investor is a different story.

What I found shocking about all this was the number of people who seemed to think my line of thinking was "wrong" or out of the loop at the current time. It makes me extremely cautious in the current state of global markets, and I think the smart move from here leading into Q2 will be coming up with new out-of-the-box ideas. Necessities and items that people will always need or see demand. I will also be finding several weak markets that will see collapsed demand and look for short opportunities. The majority of these ideas will be posted on our blog, while the specific details and management of the trade will be made available for subscribers.

Bloomberg Commodities Index:

Around December 2020, I shared the first instance of a mega move in commodities. Now more than one year later, it was no different. I expect many of these assets to form new all-time highs and continue breaking out. It truly is the sector to allocate capital into even a year into the cycle. You can see the continuation in the charts below, and in oil.

Our tools indicate more continuation up to $100, while my theory is that we continue to ride this until the market tells us otherwise. Emporos Research will up the oil forecast to a $150 target. I started the oil idea way back in November 2020 when it traded at around $30. I have no plans to leave you all hanging with regards to, in my opinion, the most remarkable and most straightforward trade of the year.

I have selectively used our algorithms to make great trades on agriculture commodities and all markets. We offer a total of 10 indicators. Sign up for a month and send me your feedback. If you have any questions regarding our trading suite of indicators, please do not hesitate to contact me. Anyone who receives our content can use the code EMP22 for 30% off any plan.

Emporos Research will send new ideas in the next issue once the markets give us a new signal confirming our theories and research. In the meantime, I hope these brief updates helped share a new perspective with you all. Inflation is still here and doesn't seem to be going away.

I will see you in the next issue!

Until next time,

-Emporos